Sales of existing homes were up in November 12 percent from a year ago and 4 percent from October to a seasonally adjusted annual rate of 4.42 million, the National Association of Realtors reported.

At the same time, NAR issued its long-awaited downward revisions of existing-home sales numbers from 2007 to this year, adjusting them down about 14 percent. NAR has said that, starting in 2007, the group's estimates were too high due to a faulty method of tracking sales. Most notably, the "For Sale by Owner" portion of the market dropped dramatically during the housing crash, for which NAR had not accounted.

“In essence, Realtors began to capture a greater market share. In addition to a decline in FSBO transactions, more builders began marketing new properties through real estate brokers that weren’t completely filtered from the existing-home data,” said NAR's Chief Economist Lawrence Yun. “Some property listings on more than one MLS, and issues related to house flipping, also contributed to the downward revisions.”

The new estimates didn't affect median home prices or month-to-month or year-to-year percentage changes in home sales.

NAR also reported that existing home inventory for sale now stands at its lowest mark since 2005.

Total housing inventory at the end of November fell 5.8 percent to 2.58 million existing homes available for sale, which represents a 7.0-month supply at the current sales pace, down from a 7.7-month supply in October.

The national median existing-home price for all housing types was $164,200 in November, down 3.5 percent from a year ago. Distressed homes – foreclosures and short sales typically sold at deep discounts – accounted for 29 percent of sales in November (19 percent were foreclosures and 10 percent were short sales), compared with 28 percent in October and 33 percent in November 2010.

All-cash sales accounted for 28 percent of purchases in November; they were 29 percent in October and 31 percent in November 2010. Investors make up the bulk of cash transactions.

Investors purchased 19 percent of homes in November, little changed from 18 percent in October and 19 percent in November 2010. First-time buyers accounted for 35 percent of transactions in November, up from 34 percent in October and 32 percent in November 2010.

Single-family home sales rose 4.5 percent to a seasonally adjusted annual rate of 3.95 million in November from 3.78 million in October, and are 12.9 percent above the 3.50 million-unit level in November 2010. The median existing single-family home price was $164,100 in November, down 4.0 percent from a year ago.

Existing condominium and co-op sales were unchanged at a seasonally adjusted annual rate of 470,000 in November and are 6.8 percent higher than the 440,000-unit pace one year ago. The median existing condo price6 was $164,600 in November, which is 0.2 percent below November 2010.

Regionally, existing-home sales in the Northeast jumped 9.8 percent to an annual pace of 560,000 in November and are 7.7 percent above a year ago. The median price in the Northeast was $240,200, which is 0.1 percent below November 2010.

Existing-home sales in the Midwest rose 4.3 percent in November to a level of 960,000 and are 15.7 percent higher than November 2010. The median price in the Midwest was $133,400, down 4.0 percent from a year ago.

In the South, existing-home sales increased 2.4 percent to an annual pace of 1.74 million in November and are 12.3 percent above a year ago. The median price in the South was $143,300, which is 2.1 percent below November 2010.

Existing-home sales in the West rose 3.6 percent to an annual level of 1.16 million in November and are 11.5 percent higher than November 2010. The median price in the West was $195,300, down 8.4 percent below a year ago.

Related Stories

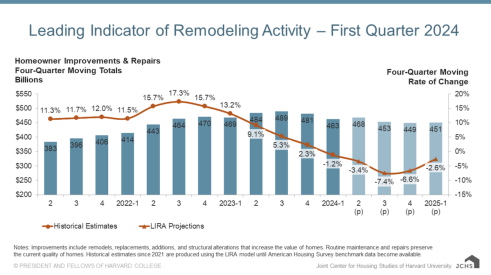

Harvard Says Remodeling Spending Downturn to Slow

Could the drop in remodeling spending from post-COVID levels regulate soon?

How to Increase Your Odds of Closing Remodeling Sales

Use these tips to hone your sales process and grow close ratio

The Remodeling Market Could Turn in Q4, Says Harvard

Repair and remodeling spending could see an uptick at the end of the year

How to Communicate with Today's Cautious Remodeling Client

Amid economic skepticism, Americans continue to spend. Now, how can you get them to spend on remodeling?

Building Materials Show Stability in 2023

Although supply chain bottlenecks have eased in recent months, shortages of some key materials persist.

Remodeler Sentiment Remains Positive

Surveys reveal a strong outlook, and how the aging population will lift remodeling

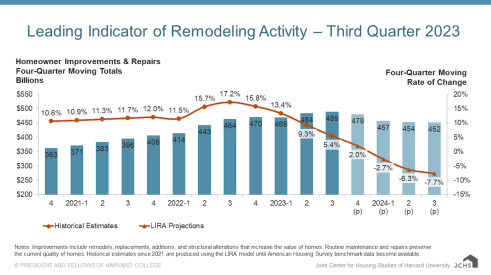

Next Year to Challenge Remodeling, Says Harvard

The latest LIRA report predicts greater decrease in home improvement and remodeling spending

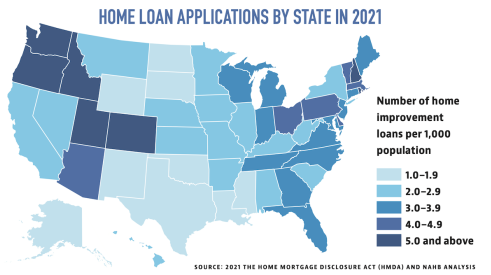

Remodeling Loan Data Reveals Geographical, National Trends

An analysis of loan data shows the most popular, and least popular, states for home improvement

Remodeling Spending to Decline at Faster Rate, Says Harvard

Remodeling spending may drop for the first time since 2020, according to predictions from Harvard's Remodeling Futures Program