National Data for the remodeling industry is hard to come by considering the market is so fragmented and localized. That’s why the comprehensive data from Harvard’s Joint Center for Housing Studies is especially important.

The following is a special selection of data compiled and analyzed by researchers Abbe Will and Kermit Baker as part of the Remodeling Futures Program of the JCHS, which is a comprehensive, ongoing study of the factors affecting home repair and renovation activity in the U.S.

The selected data provides insights into spending habits and influencers, shows a seven-year increase in remodeling firm payrolls, and ultimately describes an industry where an aging housing stock is helping to increase demand for exterior replacement contractors.

Source: JCHS tabulations of HUD, American Housing Surveys

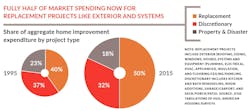

Answering two questions—what kind of jobs are in demand; and professional or DIY?—Will’s research illustrates strong demand for replacement work and a clear preferance for professional installation. That’s particularly true for homeowners who’ve been in their homes for at least 20 years, whom we can assume are mostly older. That’s important, because 53 percent of home improvement spending is done by persons 55 and over. Other in-demand jobs not pictured include disaster repairs.

Source: JCHS tabulations of HUD, American Housing Surveys

Replacement projects do, though, account for the lion’s share of remodeling spending (50 percent)—up from 40 percent in the two decades prior. Researcher Abbe Will provided additional data (not shown) that confirmed in 2017, more than 80 percent of spending on replacement projects went to professionals.

Source: JCHS tabulations of HUD, American Housing Surveys

Not surprisingly, older homes (that is, homes built before 2000, and especially before 1970) average higher spending on remodeling projects, and particularly replacement projects.

Source: HUD, American Housing Surveys

America’s housing stock is aging. The median age of owner-occupied homes hasn’t seen a year-over-year decrease since before 1985. If the trend of homeowners either buying or remaining in older houses persists, the remodeling industry could continue to see significant growth.

Source: U.S. Bureau of Labor Statistics

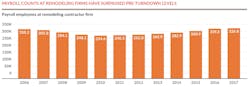

Corresponding to a bounceback from the 2007/2008 financial crash, remodeling firm payroll counts have been increasing since 2010, and in recent years have even surpassed pre-crisis levels.

About the Author

James F. McClister

James McClister is managing editor for Professional Remodeler.