Construction spending rebounded in February with gains from depressed January levels in residential, private nonresidential, and public investment, according to an analysis of new U.S. Census Bureau data by the Associated General Contractors of America.

Related Stories

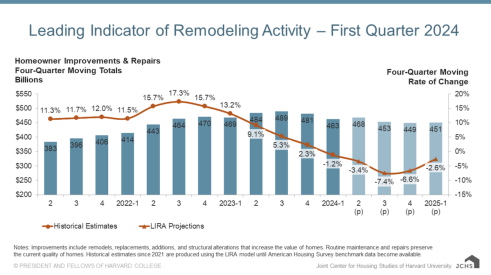

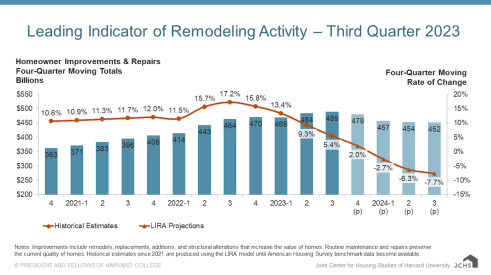

Harvard Says Remodeling Spending Downturn to Slow

Could the drop in remodeling spending from post-COVID levels regulate soon?

How to Increase Your Odds of Closing Remodeling Sales

Use these tips to hone your sales process and grow close ratio

The Remodeling Market Could Turn in Q4, Says Harvard

Repair and remodeling spending could see an uptick at the end of the year

How to Communicate with Today's Cautious Remodeling Client

Amid economic skepticism, Americans continue to spend. Now, how can you get them to spend on remodeling?

Building Materials Show Stability in 2023

Although supply chain bottlenecks have eased in recent months, shortages of some key materials persist.

Remodeler Sentiment Remains Positive

Surveys reveal a strong outlook, and how the aging population will lift remodeling

Next Year to Challenge Remodeling, Says Harvard

The latest LIRA report predicts greater decrease in home improvement and remodeling spending

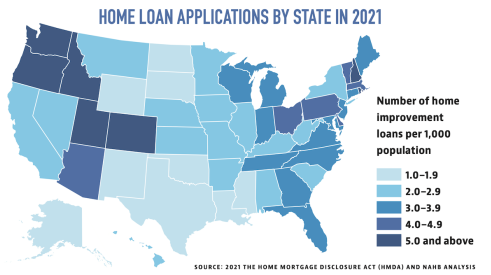

Remodeling Loan Data Reveals Geographical, National Trends

An analysis of loan data shows the most popular, and least popular, states for home improvement

Remodeling Spending to Decline at Faster Rate, Says Harvard

Remodeling spending may drop for the first time since 2020, according to predictions from Harvard's Remodeling Futures Program