Expenditures for residential home improvements soared 13% to $328 billion in 2021 from $289 billion in 2020, according to the Bureau of Economic Analysis’ National Income and Product Accounts. This is the largest increase in home improvement spending since 1993 when it saw a 16% gain.

The significant gain in residential remodeling was fueled in part by changes in housing and lifestyle decisions made during the COVID-19 pandemic. The market in 2021 also benefited from solid existing home sales, high home price appreciation, high incomes, and an aging housing stock.

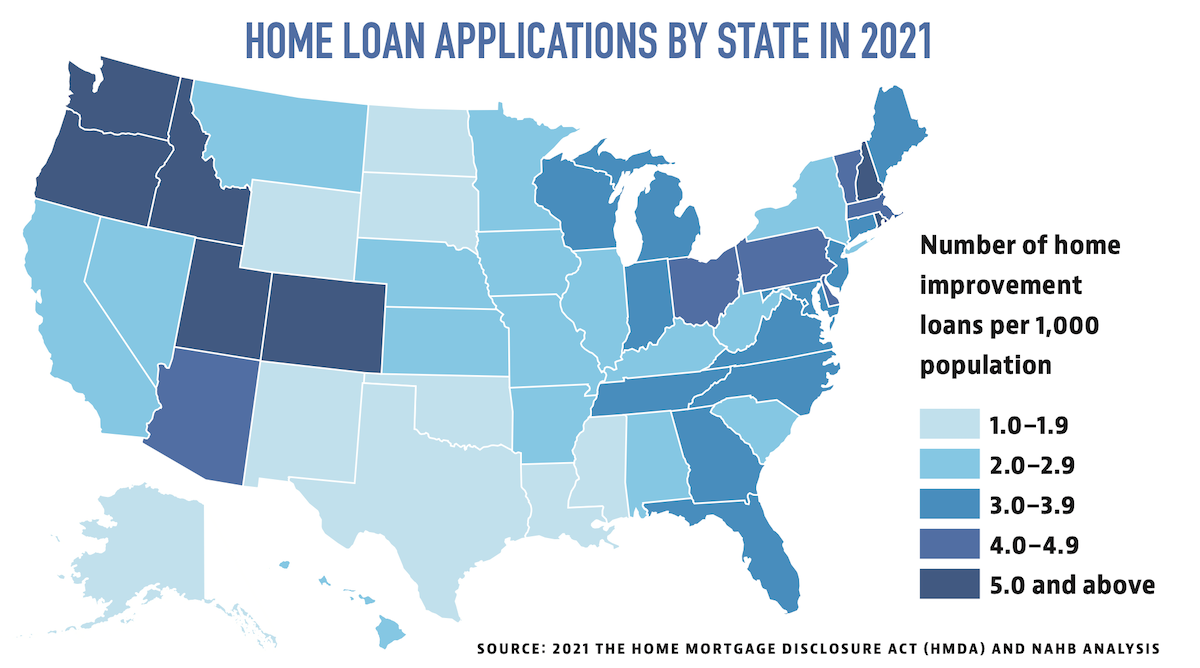

NAHB Economist Jing Fu analyzed data mandated under the 2021 Home Mortgage Disclosure Act (HMDA) and published by the Consumer Financial Protection Bureau and found significant variations in market activity based on location. Her analysis of the HMDA data offers a good look at remodeling activity by state and county.

Looking at total home improvement loan applications by state, it’s no surprise that California, the most populous state, tops the list with the highest number of home improvement loan applications in 2021 at 109,856 applications. Florida is second with 82,341 home improvement loan applications. On the other end of the spectrum, Wyoming and Alaska had the lowest total numbers of applications, which were below 1,000 in both states.

Looking instead at home improvement loan applications per 1,000 population, two states in the mountain west—Utah and Idaho—had the highest number of applications, with rates of 7.6 and 7.4 applications per 1,000 population. Rhode Island (6) and New Hampshire (5.4) ranked third and fourth, followed by Colorado with a rate of 5.3. Alaska had the fewest applications per 1,000 population, with a rate of 1.2.

Aggregate across all states, there were 3.3 loan home improvement loan applications for every 1,000 population.

Add new comment

Related Stories

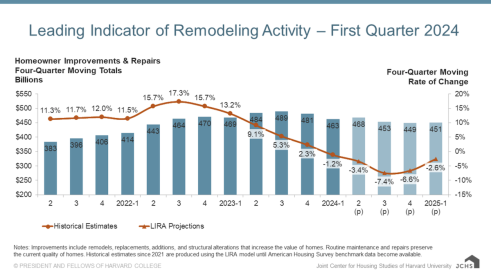

Harvard Says Remodeling Spending Downturn to Slow

Could the drop in remodeling spending from post-COVID levels regulate soon?

How to Increase Your Odds of Closing Remodeling Sales

Use these tips to hone your sales process and grow close ratio

The Remodeling Market Could Turn in Q4, Says Harvard

Repair and remodeling spending could see an uptick at the end of the year

How to Communicate with Today's Cautious Remodeling Client

Amid economic skepticism, Americans continue to spend. Now, how can you get them to spend on remodeling?

Building Materials Show Stability in 2023

Although supply chain bottlenecks have eased in recent months, shortages of some key materials persist.

Remodeler Sentiment Remains Positive

Surveys reveal a strong outlook, and how the aging population will lift remodeling

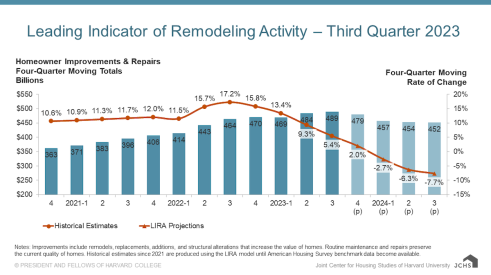

Next Year to Challenge Remodeling, Says Harvard

The latest LIRA report predicts greater decrease in home improvement and remodeling spending

Remodeling Spending to Decline at Faster Rate, Says Harvard

Remodeling spending may drop for the first time since 2020, according to predictions from Harvard's Remodeling Futures Program

Working to Create a Strong, Skilled Workforce

Remodeling is booming, but labor shortages continue to challenge the industry